Avoid This Bursting Bubble…

- Insane price targets are back…

- Tesla shares are sliding…

- Is the market’s newest mini-bubble bursting?

Bubble trouble is brewing in the markets again…

No, the major averages aren’t back on the brink of total destruction. In fact, most stocks have been chopping along over the past few weeks. If there are signs of stress, you won’t find them among the large-cap leaders. The S&P 500 remains less than 2% removed from year-to-date highs.

But if you dig a little deeper, you’ll find many of this year’s speculative leaders are beginning to crack.

Two bubbles are deflating. One’s old, and one’s new – and both could have serious implications for the broad market.

If investors are selling their riskier stocks again, is it only a matter of time before they back away from the market entirely?

Let’s break it down…

Insane Price Targets are Back?!

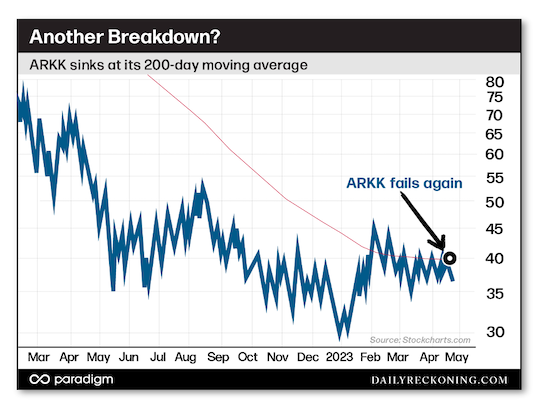

Just last month, I asked if Cathie Wood’s ARK Innovation Fund (ARKK) had sprung a major leak. ARKK was wandering aimlessly following the January snapback rally, failing to post a meaningful breakout above its 200-day moving average following several attempts.

The tech-growth names that fueled the Covid Bubble aren’t exactly setting the world on fire right now. Yet they did appear reinvigorated earlier this year following a disastrous 2022 performance.

Unfortunately, most of these stocks have failed to maintain their first-quarter momentum.

These facts alone are cause for concern. After all, sharp “echo rallies” that eventually roll over lead to new lows are one of the hallmarks of extended bear markets. Following last summer’s powerful, 20%-plus relief rally that ultimately melted down, it’s prudent to assume unprofitable tech will need more time to base out before we can expect a genuine breakout.

But we’re also beginning to see signs of desperation from the tech cheerleaders.

Cathie’s back to her old tricks – setting outrageous price targets for her darling innovation stocks. Once again, Tesla Inc. (TSLA) is the main target of her fantastic visions as she proclaims the electric car pioneer’s shares will top $2,000 by 2027.

No, I didn’t accidentally tack an extra zero on a $200 price target. The ARKK boss is claiming that TSLA – a stock that is currently trading for about $160 – will rally more than 1,000% in the next five years.

Her prediction is based on the assumption that Tesla mobilizes a revolutionary robo taxi fleet based on its rollout of full self-driving technology, which she estimates would contribute up to $10 trillion in revenue by 2023. Now, I’m no futurist. But the sheer size of this guess – $10 trillion! – feels completely insane. I can’t imagine a scenario where self-driving tech from one company is kicking off revenue that’s nearly four times the entire current market capitalization of Apple Inc.

Meanwhile, back in reality, Tesla shares are sliding – and ARKK is on the verge of breaking down… again.

After multiple attempts at clear $40 and its 200-day moving average, ARKK faltered last week and is extending lower. Shares tagged new one-month lows on Monday and appear to be on track for a test of $35.

Don’t hold your breath hoping for a quick recovery here – that $40 wall is back after a failed breakout in February. If this thing loses $35, I think we’ll see new lows within a few weeks.

Is the Market’s Newest “Mini-Bubble” Bursting?

The Covid Bubble stocks aren’t the only stragglers…

The market’s newest fad is also dealing with an ugly reality check.

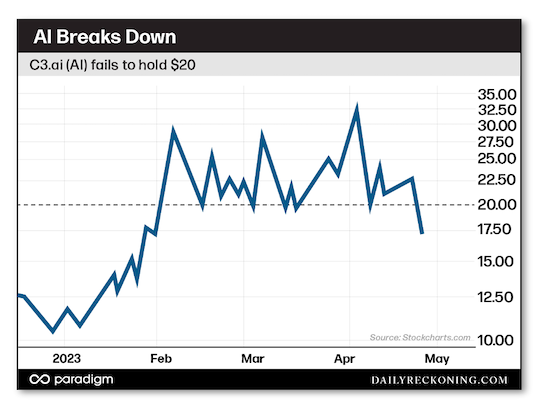

Artificial intelligence pure plays are breaking down in a big way this week. C3.ai Inc. (AI) has been the poster child for the frothy sector. Shares shot up by as much as 200% so far this year as speculators latched onto the biggest new idea in tech. But following weeks of choppy consolidation – and a few wild rallies – AI and other speculative names are losing key levels.

Yes, even the market’s younger bubbles are feeling the heat. The AI stocks didn’t get a ton of press during the 2022 meltdown. And they weren’t exactly lumped in with the tech-growth trade that dominated the speculative landscape. In fact, AI didn’t even debut on the market until Dec. 2020 – just before the final exhaustion highs registered in early 2021. Bad timing!

But out of nowhere, AI became the hottest idea on the markets as programs like ChatGPT took the internet by storm. Unfortunately for the bulls, the rest might be history… at least for now.

AI was hit hard earlier this month by an analyst short report that raised some serious questions about the company’s accounting practices. That triggered the initial decline. Now, we’re seeing follow-through to the downside as AI breaks below the critical $20 level that acted as support since the explosive January rally.

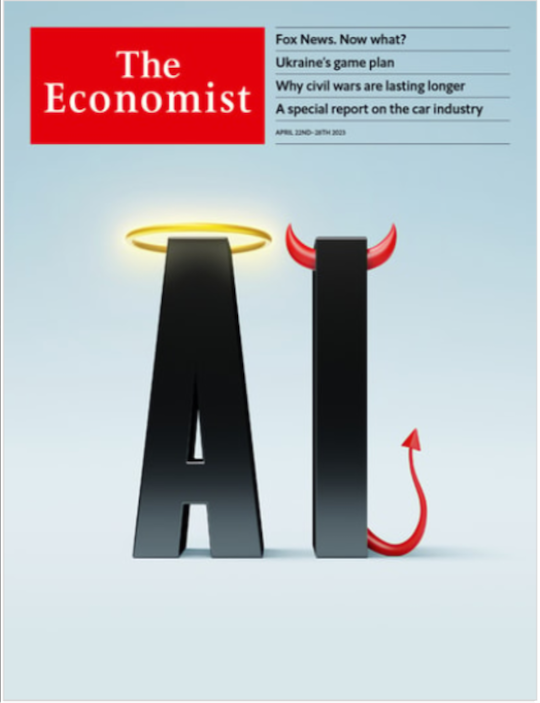

As if this wasn’t enough bad news for the stock (and sector, for that matter), the latest cover of The Economist has AI in its crosshairs…

It’s usually a good idea to get out of the way of a trend once it has caught the eye of the editors of the major finance rags. Perhaps a serious hard reset is in order here after a price breakdown and mainstream media attention…

Will the selling in tech-growth and artificial intelligence lead to a broad market selloff? Or am I barking up the wrong tree?

Comments: