How Much Money Is Inflation Costing You?

The stock market was down big again today, with the Dow hitting a new low for the year. Just about everything else was down today too. The Fed really has Wall Street spooked, as it’s aggressively raising rates to try to get a handle on inflation (even though it won’t).

The latest inflation numbers show that inflation is persistent, as we knew it would be. That includes sectors without much price movement and others that seem out of control.

This transitory inflation is looking more and more persistent. It’s worse in some sectors than others but it is hitting absolutely everything. Half of the retailers in the U.S. are preparing to increase prices even more, sooner rather than later, just to survive their own increased costs.

The pattern of 40 years — in which prices felt reliably stable and predictable — has been shattered.

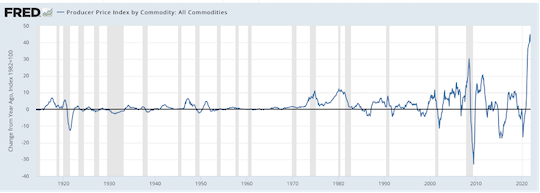

There are many ways to look at this data, but one that brings great clarity is to set 1982 at 100 and see the percentage change in the index. Here you gain a real sense of the gravity of what we are living through now.

The Ravages of Inflation

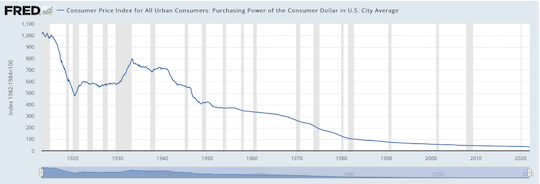

What does all this mean for the purchasing power of the dollar? This chart was once difficult to find but now the folks at the St. Louis Fed have made it easier. This line charts purchasing power from 1913 (when the Fed came into existence) to the present. Check it: The $1 of 1913 is now worth 3.6 cents. Yikes!

That’s a pure wealth transfer from the people to the state, all manufactured to fund a massive debt. The government, the banking system and the Fed have become quite the beast, devouring the standard of living in systematic ways for many decades.

The proceeds have funded the wars, the welfare, the rise of the administrative state, the despotisms and tyrannies and finally the lockdowns. That’s when the Fed unleashed the helicopters to drop money all over the country.

What the heck did they think was going to happen? Just as the CDC forgot about natural immunity, the Fed seems to have forgotten the equation of exchange. The latest data is only alarming because it is happening at a faster pace, one that we notice in real-time.

The Fed’s ideal rate of monetary depreciation is 2%. The “failure” we experience now is merely that they sped up the pace in ways they cannot manage.

By the way, the velocity of money is still far lower than in pre-pandemic levels. That means that inflation has a very long way to go before it normalizes. I’m still not yet seeing a Weimar-style meltdown in our future, but I’m also aware that this is what German economists were saying in 1920.

An Extra $250 Every Month

The Wall Street Journal calculates that the average household is spending $250 more per month now than last year on the same goods and services. That’s some serious tax and a tremendous blow to the American standard of living.

Only two years ago, getting a 5% raise was considered really generous. Now that means your salary is lower in real terms than it used to be. It’s a salary cut — one which people would not accept if it occurred in dollar terms. Inflate it away and loss becomes more difficult to see.

Wells Fargo found that the classic American Super Bowl party cost 14% more this year than the year before, and the biggest offender was meat prices. Beef, chicken and pork are all way up, owing in part to supply chain breakages and shipping costs. Steak is mostly out of the question at 21% annual increases.

At least you can reliably buy chicken. But The New York Times, always ready to spread guilt and shame to the American consumer, warns that while the chicken market is thriving, “these gains have come at extraordinary cost to the chickens themselves.” I suppose that’s technically true since we kill and eat them.

The same paper this year issued a massive paean to the school of thought called “Modern Monetary Theory.”

“Not My Fault!”

Ms. Stephanie Kelton, 52, is the most familiar public face of Modern Monetary Theory, which posits that if a government controls its own currency and needs money — to make sure its citizens have food and places to live when, say, a global pandemic pushes many out of work — it can just print it, as long as its economy has the ability to churn out the needed goods and services.

Now she is in an awkward position. “Not my fault!” she says in so many words. She has a Substack account that blames the current sufferings of the American people on everything but the Fed. Many people are ready to agree.

So much wrong has been done over the last two years, but we are hard-pressed to find anyone who is willing to take responsibility. Even the architect of New York City’s awful pandemic response — you know, the one that has turned a world-class city into a dump that millions of residents have fled — has written that it’s not her fault.

True, she says, everyone could use a bit more humility and better “tools” (everyone’s favorite word these days), but they did their best and promised to do better next time.

Her piece in the NYT actually includes the following: “Some people do not find it acceptable to wear masks continuously during the day. Some parents worry about potential speech and development delays from masks, even though that remains unproven.”

So now we need some scientific study to demonstrate that strapping masks on kids’ faces for two years is bad for their development. Ridiculous. The sheer cruelty of these officials is as boundless as their capacity to deny the obvious.

The more parts of life that get transferred from the private sector and controlled by free enterprise over to the administrative state, the more that goes wrong and the more difficult it is to find anyone to accept responsibility.

Comments: