The Spread of the AI Brain Worm

The artificial intelligence boom has taken the market by storm.

In fact, I believe it’s possible that the market’s sudden fascination with all things AI is the main driver of the tech sector’s strong performance so far this year.

And I’m not just talking about the bubble basket of smaller AI pure-plays, either…

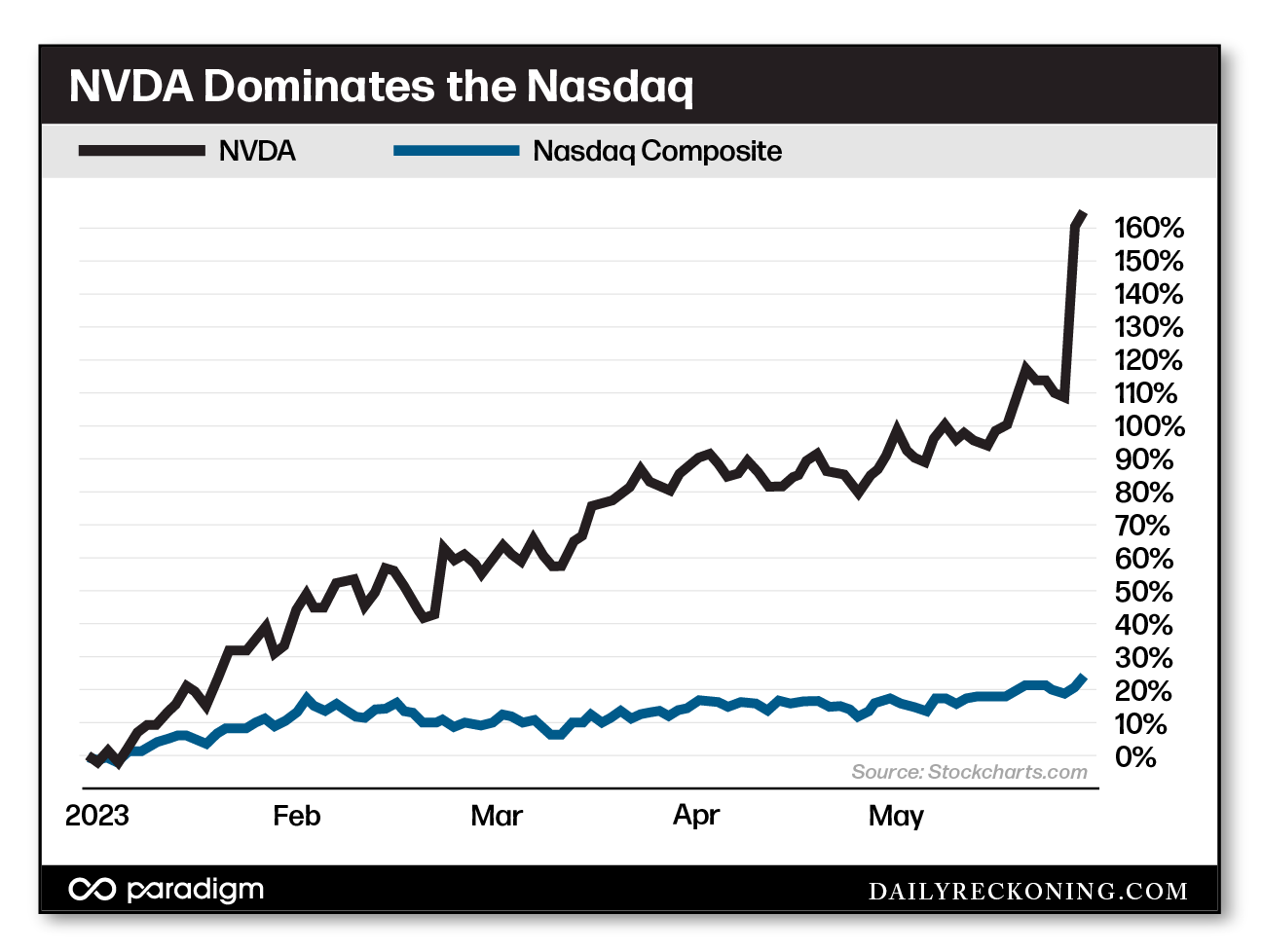

The Nasdaq 100 is now up 30% year-to-date, easily topping the S&P and the Dow. The biggest and best tech firms in the world are destroying everything in their paths — and the frenzy is being led by companies that have been the most vocal about their involvement in the burgeoning artificial intelligence industry: names like Microsoft Inc. (MSFT), Alphabet Inc. (GOOG), and NVIDIA (NVDA).

During the first quarter, we discussed the bubbly action in some of the smaller AI names and how traders were grabbing shares of every AI-adjacent stock they could find as the financial media cranked out breathless essays on the newfound power and potential of these innovative companies.

Sure, we saw some serious froth. Pure-play AI bubble superstar C3.ai Inc. (AI) jumped more than 200% to kick off Q1 in style. It’s even managed to cling to these gains despite some sloppy consolidation, proving just how serious these speculators are at white-knuckling even the most volatile stocks involved in AI tech.

But the insane earnings reaction to NVDA last week shows just how much the AI brain worm has proliferated in just a few short months. Not only did the company beat estimates, management also projected huge sales of chips to meet demand for the coming artificial intelligence boom.

What resulted was one of the strongest positive earnings reactions I’ve ever seen…

Occasionally, you’ll see a thinly-traded microcap double overnight due to unexpected news. Or maybe a stock will rocket higher following a buyout. But to see NVDA — which was already a top ten stock by market-cap — soar nearly 30% after hours following a guidance raise is total insanity.

The exuberance continued through the week — and NVDA didn’t even give back a penny.

NVDA has now gained more than 160% year-to-date and is closing in on a $1 trillion market-cap, jumping Warren Buffett’s Berkshire Hathaway to become the fifth-largest publicly traded company in the US.

A Catalyzing Moment

The morning after NVDA launched into the stratosphere, I explained to The Trading Desk members that theeffect this has on the market can’t be understated.

Every bubble needs a catalyzing moment. NVDA blowing out earnings and propelling the Nasdaq Composite to new nine-month highs could very well become that moment for AI. We won’t know until we have the benefit of hindsight. But the strong participation from the mega-caps — combined with the speculative action down the cap scale — could be the fuel this fire needs to continue burning through the summer months.

To be clear: I’m not suggesting you have to pull up your brokerage account and buy as many NVDA shares as possible this very second. If this bubble is indeed in the early stages, you’ll have ample opportunities to ride the wave.

But in order to profit from these emerging trends, you need to know roughly where we are in these market cycles, as well as how similar scenarios have typically played out in the past.

Narrative Shift

The NVDA post-earnings rally could have solidified a powerful narrative shift for the AI movement.

It’s hard to believe, but NVDA was not a stock anyone wanted to own last year. In fact, NVDA lost almost 70% of its value from its apex in late 2021 until it bottomed out in early Q4 2022. Crypto mining had tanked, demand for the company’s higher priced units was soft, and (most importantly) no one wanted anything to do with tech stocks.

In a vacuum, nothing is fundamentally different with the company. And the stock is expensive by almost any metric we can concoct. Instead, investors’ perceptions of NVDA and its potential are the main forces at work here.

Markets are forward looking — you probably hear that all the time! But it’s important to remember that this is especially true when it comes to those magical bubble themes that manage to capture everyone’s imagination every few years…

The big question now is staying power. Artificial intelligence hype felt like it came out of nowhere just a few months ago.

Will it disappear just as quickly as it emerged?

Or, will it continue to snowball into and convert more market participants into true believers over the next several quarters and beyond?

These are the questions the market will have to answer. In the meantime, we can stay active in the AI space by watching for a rotation into the smaller names when NVDA begins to consolidate its earnings bump. I suspect traders will be itching to dive into the next hot AI stock as soon as NVDA slows down, fueling a rotation into other names in the space.

We should also watch to see how NVDA and some of the other big-name players in the space digest their respective gains. Sideways corrections — rather than sharp pullbacks — would indicate the underlying trend remains strong.

If that’s the case, buying bounces off support will be a great way to get involved without chasing any of the big gaps higher.

What do you think? Is the AI zeitgeist here to stay? Or is it destined to crash and burn? Let me know by emailing me here.

Comments: