Minds Off, Profits On: AI Revival Begins

Following nearly two years of rate-hike induced panic attacks, investors suddenly found inner peace following this month’s cooler-than-expected CPI report.

Everyone’s now convinced the Fed has whipped inflation and won’t raise rates again this cycle. The herd can’t stop buying semiconductors, languishing IPOs, and beaten-down tech stocks. Melt up season has begun — and there’s very little standing in the way of the rally as the averages blast higher into 2024.

Now, I know what you’re thinking…

More than a few of these eager speculators scooping up stocks right now might be suffering from short-term memory loss. Wasn’t Jerome Powell just saying he’s not confident that the Fed is making the necessary headway to get to its magical 2% inflation goal? How could anyone feel comfortable buying stocks into the end of the year with wars raging, mega-cap valuations stretching, and squishy economic data?

Do yourself a favor and table those concerns for the next few weeks. Right now, we need to be good little traders, scooping up stocks with both hands alongside the unwashed masses as the averages explode higher. I’ll be blunt: If you want the chance to book outsized gains during these ideal market conditions (which only come around two or three times per year), you need to turn off your brain and start buying.

One of the most critical market lessons you’ll ever learn is that profitable traders need to reject the idea that fundamental or economic information has any predictive power over short-term price fluctuations. It’s undeniable that fundamental and economic analysis are important in the long run. But they will never help you time your buying and selling.

In reality, the market isn’t going to wait around for “perfect conditions” before it begins to rally. In fact, the action we’re witnessing right now is happening because the herd was way too bearish during the October washout. The gloom and doom hit nosebleed levels during what’s typically a seasonally weak period for stocks — just as the major averages threatened to drop below key support levels. It was the perfect storm for an end-of-year melt up to emerge.

Last week, I briefly mentioned a few ideas that I believe have a shot at streaking higher into 2024. I’m focused on rate-sensitive growth names in tech: software stocks, biotechs, and the former tech-growth darlings are ripe for huge short-covering rallies. These fundamentally flawed names sporting hot charts will be the best trades over the next seven weeks.

Today, let’s narrow our focus to pinpoint some of the best potential plays in these newly resurgent groups.

Time to Re-inflate the AI Bubble?

Here’s an important question heading into the holiday season: Can a fresh melt-up rally help breathe new life into a sagging bubble?

More importantly, when was the last time you peeked at the speculative artificial intelligence stocks that captured investors’ imaginations earlier this year?

To be fair, the artificial intelligence bubble isn’t completely dead and buried. But NVIDIA Corp. (NVDA) did put most of the speculative AI names on life support. The semiconductor behemoth has captured the bulk of the artificial intelligence hype since the first quarter, logging an insane 225% year-to-date gain. Meanwhile, the more speculative names have fallen out of favor.

That could change as traders look to rotate out of the big, year-to-date winners and into riskier plays as the melt up matures.

We’re already starting to see the news cycle refocusing on AI developments. AirBnB Inc. (ABNB) recently acquired Gameplanner.AI for $200 million, proving there’s still plenty of cash sloshing around in the coffers of some of these pandemic darlings.

Even more impressive is the fact that the artificial intelligence startup Gameplanner.AI has only been around since 2020. The buzz — and impressive valuation — loves to follow the company’s CEO, who just so happens to be one of the founders of Siri, Apple’s famed voice assistant.

To put this into context, I do think there’s an AirBnB bubble out there in many destination cities — a phenomenon that’s beginning to unwind. So it’s probably a good idea for ABNB to backstop its business with what will probably become some sort of AI concierge to better connect users with vacation properties.

You might even see the acquisition as a bullish development. But ABNB shares have only rallied modestly since the announcement — and the stock remains stuck well below its year-to-date highs. But perhaps we can look forward to some additional catalysts for these potentially bubbly names.

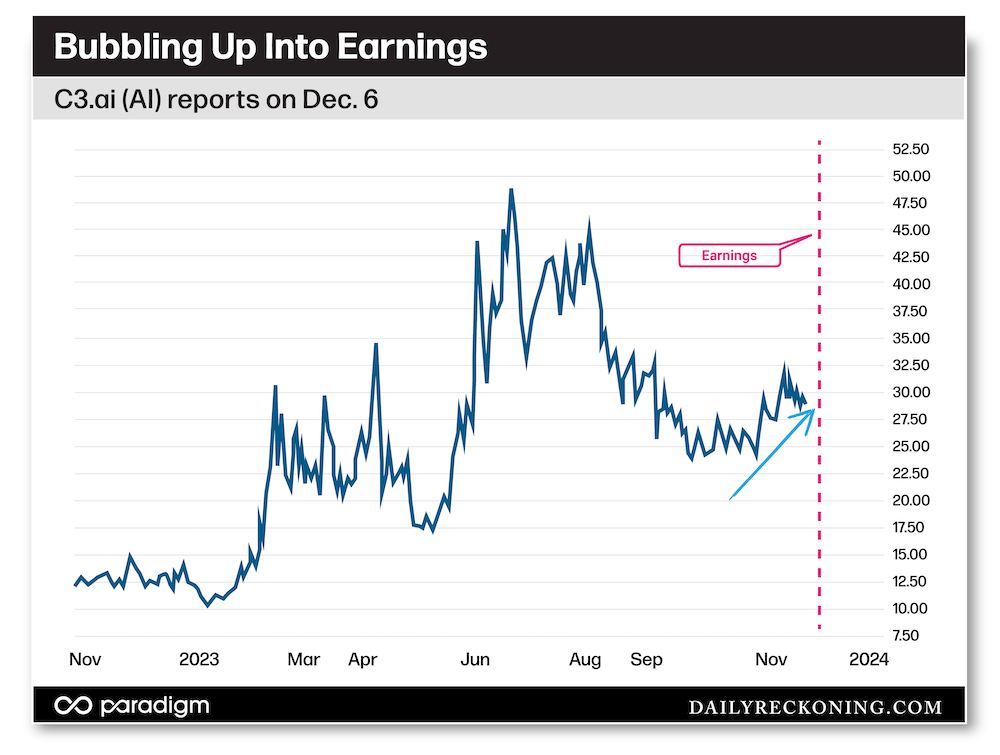

Then there’s C3.ai Inc. (AI), the quintessential artificial intelligence bubble pure play that ran laps around the value crowd earlier this year, exploding higher by more than 370% at one point back in late spring.

But AI (the sector and the stock) fell off the radar following the summer tech rally. AI shares faltered as the tech-growth trade started to unwind, and were promptly chopped in half in just three months.

While AI has regained some of that lost mojo in November, it has yet to recapture the magic of its early 2023 run.

Perhaps a favorable earnings announcement will help AI recapture its lost momentum. THe company is set to release earnings on Dec. 6 as the stock claws its way back toward the $30 line in the sand.

Can AI become one of the market’s dominant trading vehicles once again?

It’s possible. There’s still plenty of hype and mystery surrounding the AI movement, which can certainly give a speculative runner the edge it needs to attract rabid buyers. The year-end melt up also offers a helpful tailwind.

Of course, snagging shares ahead of earnings adds an extra layer of risk to any trade. A more prudent option is waiting for the reaction, then playing for a post-earnings drift on any positive momentum.

If you’re bullish AI and you want a safer bet that’s less susceptible to earnings madness, the Global X Robotics & Artificial Intelligence ETF (BOTZ) is another solid bet.

What do you think? Will the AI bubble find new life into the holidays? Or is it a dead trade walking? Let me know by emailing me here.

Comments: