The Coming Carmageddon

[Urgent Note: The nation’s future and a massive debt ceiling hangs in the balance as Trump pushes beyond the Comey hearings. That’s why I’m on a mission to send my new book TRUMPED! A Nation on the Brink of Ruin… and How to Bring It Back to every American who responds, absolutely free. Click here for more details.]

Ben Bernanke’s successors at the Fed and other global central banks still don’t get it.

Falsified debt prices do not promote macroeconomic stability. They lead to reckless credit expansion cycles that eventually collapse due to borrower defaults. We’re now seeing that play out in the auto sector, especially since anyone who can fog a rearview mirror has been eligible for a car loan or lease.

If that reminds you of the sub-prime housing disaster, you’d be right.

That, in turn, will make the looming collapse even worse, due to the sudden drastic shrinkage of credit in response to escalating lender losses.

How did we get here?

Let’s start by looking at the Fed. Its reckless monetary reflation cycle in response to the Great Recession caused auto credit, sales and production to spring back violently after early 2010.

Accordingly, that reflation has powerfully impacted the growth rate of total U.S. domestic output. And it’s had a massively distorting effect.

Auto production has seen a 15% gain over its prior peak, and a 130% gain from the early 2010 bottom. But overall industrial production is actually no higher today than it was in the fall of 2007. Real production in most sectors of the U.S. economy has actually shrunk considerably.

That means if you subtract the auto sector, there has been zero growth in the aggregate industrial economy for a full decade.

So the auto industry has actually distorted the effects of monetary central planning.

But the real point here is that the financial asset boom-and-bust cycle caused by monetary central planning is making the main street business cycle more unstable, not less. And it means the next auto cycle bust is certain to be a doozy.

It also means the weak expansion of real sales and GDP over the past seven years has been artificially supported by a rapid but unsustainable snapback in the auto sector. But that is now over.

And what I call Carmegeddon will soon be now metastasizing rapidly.

Consider that credit analysis in the auto sector is now being overwhelming driven by the collateral value of the vehicle — not the creditworthiness of the borrower.

Accordingly, when car prices fall sharply, losses from loan defaults will soar. During the last cycle, used car prices peaked in early 2006 and then fell nearly 25% through the 2009 bottom. Total auto credit cratered during the same period.

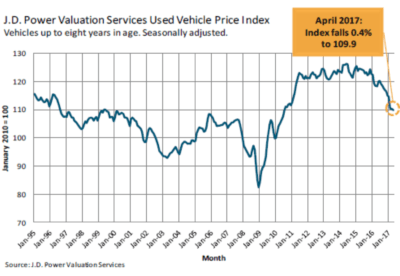

And today, after plateauing for more than two years, used car prices have now begun a steep descent. During April, for example, prices of most classes of used vehicles plunged sharply. The J.D. Power index was down 13%. Needless to say, the drop in used car prices is now accelerating.

But it still has a long way to go due to the rising tide of used cars from maturing leases and loans that are hitting the markets.

Looking back to the last credit cycle, the crash of new cars sales after 2007 resulted in a drastic shrinkage of leased vehicles. Accordingly, volumes of pre-owned vehicles hitting the used car auctions hit a modern low of 13 million vehicles during 2011-2013. That supply shortage obviously fueled a sharp rebound of used car prices.

By contrast, the post-2010 auto sales boom is now generating an all-time record tsunami of pre-owned vehicles. During the period 2016-2018, an estimated total of 21 million used vehicles will have hit the market.

That 62% surge in used vehicle supply has clear, negative implications for used car prices.

The most immediate negative effect of plunging used vehicle prices, of course, is sharply reduced values among leased vehicle portfolios. That, in turn, not only results in losses for equity holders, but also causes monthly payment rates to rise sharply on new leases.

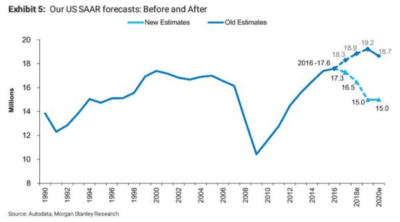

Lease volumes dropped by 45% during the last down cycle. But at current all-time highs of 4.3 million newly leased vehicles last year, volumes could drop by upwards of 70% during the years just ahead.

Indeed, more than 30% of new vehicle sales were leased in 2016. And the all-time record of 4.3 million new leased vehicles in 2016 was nearly double the 2007 peak, and 4X the 2009 bottom.

The impending plunge in used car prices will also have an even more damaging impact on the loan market.

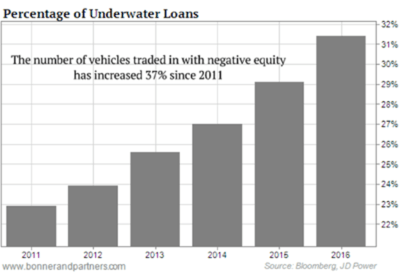

This means an increased share of old used car loans will be even deeper underwater because cars depreciate faster than loan balances can be paid down. That growing gap, in turn, will cause loan loss severities to rise during the down-cycle ahead.

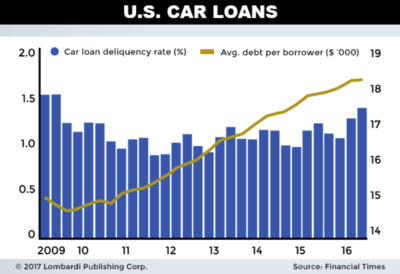

Driven by the Fed’s ultra-low rates, the eruption of subprime auto finance led to a stampede toward yield. And a large share of the $100 billion gain in subprime volume was due to financing almost entirely in the junk bond market.

The precarious nature of the debt pyramid that underlies the auto market is undeniable. The auto sector is a prime example of a false debt-fueled prosperity. It underscores how the Fed’s fake prosperity actually intensifies — if not creates — the boom/bust cycle.

Consider that nearly one-third of vehicle trade-ins are now carrying negative equity, as the below chart shows.

That means that prospective new-car buyers are having to raise increasing amounts of cash to pay off old loans.

Furthermore, outstanding subprime auto debt is nearly 3X higher than it was on the eve of the 2008 financial crisis. So the coming correction in auto loan extensions is certain to be far deeper than the 15% decline last time.

And payback time is just around the corner. The cycle of declining used-car volumes and rising used-car prices has exhausted itself. In fact, car loan delinquency rates have been rising sharply during the last several quarters.

In fact, the remaining leg of the so-called recovery is now faltering rapidly as the last subprime auto borrower who could fog a rearview mirror has been loaned a car.

Even Morgan Stanley now expects a veritable crash of used car prices. This means the auto credit auto boom is over, since the whole thing ultimately depended upon rising used car prices and collateral value for car loans and leases.

The simple reality is that the auto boom was one giant credit-driven accident waiting to happen. They called it “putting money on the hood” in the trade.

The explosion of auto credit described above — from $800 billion at the 2010 bottom to more than $1.5 trillion today — was fundamentally driven by asset inflation.

But with used car prices now plummeting, the last gasp of “borrow and spend” on the dealer lots has been exhausted. That’s why Morgan Stanley is now projecting a huge decline in car sales during the balance of this decade.

If you add faltering auto sales to the on-going Armageddon in retail and the topping out of the shale oil patch at $50 per barrel, you don’t have much of a recovery left.

In fact, you are back to the stunning reality with which I started. Namely, that a real recovery of the U.S. industrial economy never actually happened. Industrial production last month is still below its September 2007 level. And now the auto credit, sales and production bust will take it significantly lower.

So much for the Great Moderation. Monetary central planning is wrong in principle and doesn’t work in practice.

The unfolding “Carmageddon” is dramatic proof.

Regards,

David Stockman

for The Daily Reckoning

Comments: