A Real Kick in the BULLS: ATH for S&P???

Bust out the bubbly, the S&P 500 is hitting new all-time highs!

What’s that you say? Not in a partying mood?

You’re not alone. In fact, there’s a large contingent of investors who aren’t dancing in the streets following Friday’s push to fresh highs.

Yes, the S&P is soaring with nothing but blue skies above after teasing potential breakouts earlier this month and during the final week of 2023. But fewer than 10% of the S&P’s components shot to new highs during Friday’s push. That’s far from a strong showing on what should have been a memorable trading day.

It’s not the end of the world for the bulls. But this isn’t the broad push higher many envisioned when it comes to a fresh all-time high following a grinding bear market.

Unless you’ve completely ignored this year’s market action, you can probably figure out what stocks are fueling this move. Spoiler: it’s tech! Specifically, the big, bad mega-caps. The largest tech names on the market are hogging the spotlight (and the gains) as we approach the final few days of January trade. The Magnificent Seven stalwarts are, for the most part, bullying the averages and pushing toward new highs.

Everything else? Not so much.

Friday’s performance perfectly encapsulated the disconnect. Just look at the attention lavished on the semis…

Semiconductors dominated the day as the VanEck Vectors Semiconductor ETF (SMH) soared 3.8% to stretch to yet another all-time high close. World-beater NVIDIA Corp (NVDA) jumped 4%, bringing its year-to-date gains to more than 20%. Advanced Micro Devices Inc. (AMD) continued its catch-up run, rallying 7%. Not to be outdone, upstart Super Micro Computer Inc. (SMCI) exploded higher by more than 35% after raising sales and earnings guidance.

These are insane rallies – especially when you compare the combined semiconductor/big tech performance with what’s happening with some of the less popular names on the market.

Unfortunately, most traders and investors will chase these extended breakouts instead of taking the time to sift through the more unloved sectors to find the next big move.

That’s the choice you have today. You can sit around sulking because you didn’t grab shares of SMCI ahead of last week’s massive gap higher…

Or, you can get to work searching for the next opportunity. Remember, this is the stock market! Each week brings new breakouts and breakdowns we can exploit for gains. You just have to know where to look.

Recalibrated Expectations

Market action outside the mega-cap winners has been weak for one main reason: rate cut expectations have fallen dramatically over the past week.

Remember, markets are forward looking. Prices aren’t set by last quarter’s earnings or even today’s news. Instead, they reflect investor expectations for the weeks and months ahead.

WIth that in mind, the volatility uptick and skewed sector performances over the past week make perfect sense once you learn that investors believe the chance at a March rate cut is now below 50%. Just a week earlier, consensus expectations for a rate cut at the March meeting topped 80%! This is a huge shift following some relatively warm inflation data and choice words from a couple Fed governors.

Bottom line: market watchers have suddenly gotten cold feet as inflation fears heat back up. The Fed triggered the start of the November melt-up rally when Powell signaled the current rate hike cycle was finished. Now that investors are second-guessing the

That’s why the growth names have suffered this month. As buyers fought to grab NVDA shares following its big breakout, the ARK Innovation ETF (ARKK) dropped more than 10% to ring in 2024. The market has ground any rate-sensitive stock into a fine paste as skittish traders have reverted back to their pre-melt up playbook: Scoop up the “safe” mega-cap, and sell the smaller growth names.

Searching for a Small-cap Bounce

Some of the best low-risk buying opportunities come from stocks or sectors retesting key support levels.

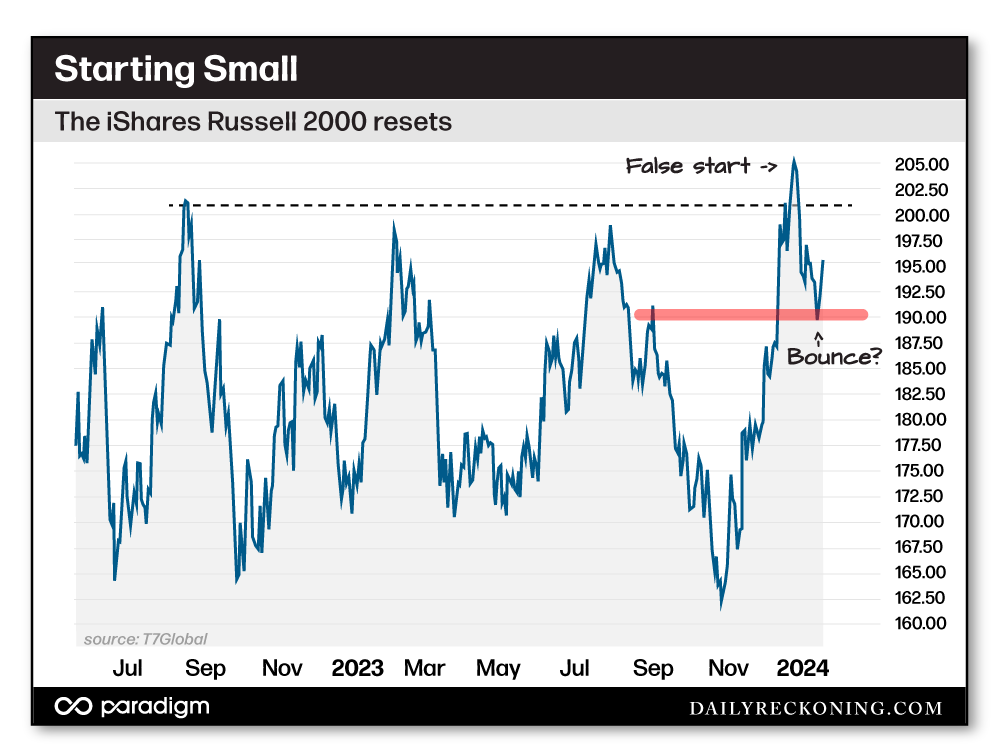

Following a four-week decline in some of the more speculative areas of the market, we don’t have to look far to find these potentially explosive charts. In fact, small-caps are potentially flashing a tradable bounce after retreating back into their consolidation range.

We saw a preview of just how strong these small-cap rallies could be during the Q4 melt up. The iShares Russell 2000 went from breaking to three-year lows in late October to a 25% gain and fresh 52-week highs in less than two months.

Obviously, this rally has cooled and IWM has underperformed its large-cap cousins by a wide market so far this year. But the small-cap index is quietly catching a bid, logging its third straight positive day with a gain of 1.5% to start the week.

More importantly, IWM might have closed that pesky mid-December gap while successfully tagging a former pivot area in the $190 range that we can trace all the way back to the 2022 bear market.

A strong move back toward $200 would mean the furious rally that began just a few short months ago isn’t quite out of steam just yet.

The contrarian-minded investor might also be glad to see that the financial media has already soured on the idea of a small-cap renaissance. The Wall Street Journal has declared small-caps dead in the water, citing the recent momentum reset, hotter inflation data, and adjusted rate-cut expectations. “The moment for small-caps might already be over,” the WSJ proclaimed on Monday.

If IWM can remain above last week’s lows, I’m giving the bulls the benefit of the doubt. I’d much rather go long IWM here than chase the extended semiconductors into the nosebleed seats…

Comments: