The “Disbelief Phase” Is Coming to an End...

Investors are already pining for the good ol’ days of 2023.

Yes, we’re just five trading days into 2024. But it appears Mr. Market’s New Year’s resolution was to pulverize the bulls into a fine powder and leave just about everyone wondering how everything changed so quickly.

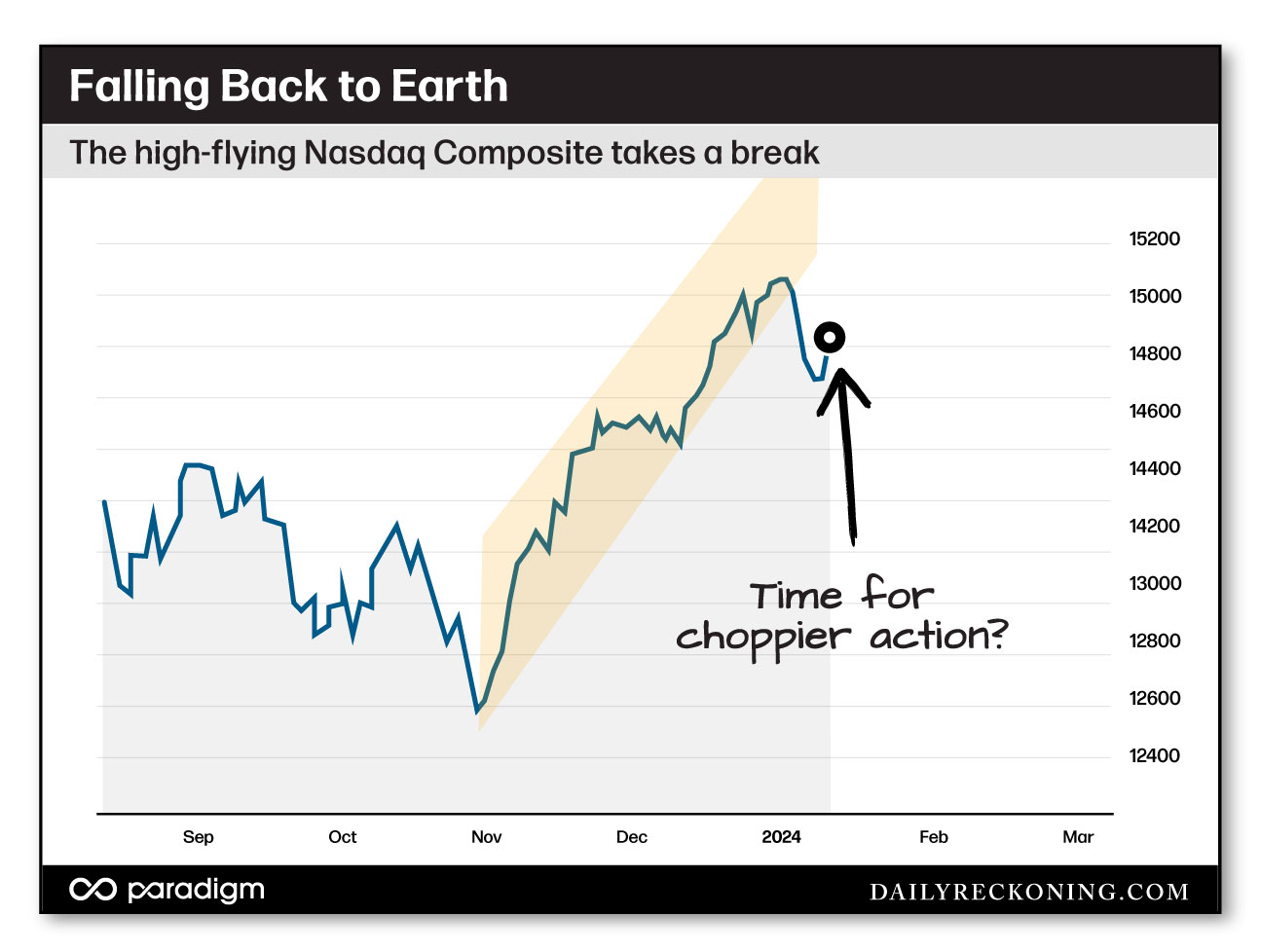

December trading finished with the S&P 500 and Nasdaq Composite posting their ninth winning week in a row as stocks rode a wave of frantic buying off the October lows. But from the opening bell of the first trading day of 2024 (which frankly feels like a lifetime ago), the market started to get a bit tricky.

The initial blow felt a lot worse due to the insane strength of the preceding two months. And if we take the time to zoom out, it’s clear that last week’s steady drop didn’t completely break the market. The S&P 500 registered a loss of just about 1.5%, which just so happens to be its first losing week since October. Meanwhile, the real damage was concentrated in the Nasdaq Composite. The tech-heavy index dropped 3.25%, leaving it just inches away from retesting its July 2023 pivot high.

Of course, these facts matter little to traders who were just beginning to buy into the melt-up rally. Recency bias plays a much larger role in investing than most market participants want to admit. We get comfortable with the way things are — and we assume the current conditions will continue forever.

Every time a formerly powerful trend abruptly reverses, investors inevitably ask the same question:

Why?

Were stocks down last week because investors were worried about the attacks on cargo ships in the red sea?

Was the market weak because of how analysts were interpreting the latest jobs report or manufacturing data?

Or, were investors simply concerned about inflation rearing its ugly head once again in 2024, stopping the Fed from beginning its rate-cut campaign in March?

What Happens Next?

To be clear, these are all viable concerns that could impact various market sectors, as well as the major averages. But these “why” questions are virtually impossible to accurately measure within market fluctuations. We could debate the various effects of certain news items until we suck every molecule of oxygen from the room. But none of our answers will get us closer to answering a much more important question: What happens next?

Fortunately, we can come closer to answering this query (and improve our market timing!) by understanding market structure and how trends typically unfold.

First and foremost: Markets rarely move in straight lines. And when they do, these sharp moves don’t end with quiet, sideways consolidations. Instead, you’ll tend to see sharp, sudden pullbacks that catch most investors off guard.

That’s exactly what we’ve seen from the market so far this month!

The Nasdaq Composite finished lower for five straight sessions. Not a buyer in sight! Every time it looked as if it might catch a bid, sellers stepped in during the late afternoon to drag the formerly red-hot tech names lower. We didn’t even sniff a decent bounce until yesterday.

Yields and the dollar also rallied, putting additional pressure on risk assets. The bulletproof Magnificent 7 stocks took a hit. The market even chewed up some of the best under-the-radar snapback performers. Tech-growth names coming out of big bases failed and moved sharply lower. And after breaking out in late December, the small-cap Russell 2000 retreated back into its choppy range. The market’s best out performers from Q4 became deadweight overnight.

A New Trading Environment?

Despite everything that’s happened so far this month, too many traders are going to be stuck on the same melt-up frequency from late 2023, despite the fact that we’re dealing with dramatically different market conditions than we enjoyed just a couple weeks ago.

If it isn’t already finished, the disbelief phase of the rally will end soon. When it does, we’re going to need to be a bit more tactical and cautious on the long side.

A weeklong skid isn’t going to tell us much about the market. But how the market bounces from here will certainly dictate how we trade for the next four to six weeks. If we see the leaders such as the semiconductors, tech-growth base breakouts, and other hot names snap back to attention, we can brush this early January action off as some much-needed profit taking.

On the other hand, we could see a weak bounce attempt that quickly runs out of steam as these market leaders approach those former highs. This is the kind of action that could lead to choppy trading and more downside heading into February.

Anything is possible. But it’s important to work out these potential scenarios so we can work up our trading plans. Instead of eagerly trying to catch falling knives as the market sorts through this rough patch, we need to respect the potential change of environment.

First, we shouldn’t blindly chase any stock that looks like it’s breaking out. In corrective markets, most breakouts will either retreat back into their former ranges or fail entirely. You don’t have to dig very deep to find the stocks that failed to hang onto breakout levels last week…

Next, we need to watch for bigger rotations occurring in the market. If new stocks and sectors start to catch higher as former highfliers sag, we need to keep up! It’s a simple concept – yet many investors still have problems quickly shifting gears when their old trades quit working.

Finally, it can’t hurt to begin searching for cheap puts to purchase if stocks post a re-energized move back to their highs. The market will eventually boil over, and it never hurts to have a little insurance for the next inevitable 5-10% pullback.

Comments: