Wall Street’s Next Big Test

Plus: An important update on my latest gold trade!

As the year-end melt up continues, I can’t help but reminisce about the insane rallies we enjoyed during the height of the Covid Bubble.

The holiday rally of 2020 featured a massive crypto rally and subsequent NFT frenzy, meme stock silliness, and unbelievable gamma squeezes that launched stocks into the stratosphere into early 2021.

It was one of those rare market moments where no analysis, charting, or common sense was required to rake in astronomical gains. If you had a brokerage account and could scrounge up a few bucks, you had a great shot to grab some of the “free money” flying around…

Of course, all periods of irrational exuberance end the same. Meme stock mania and most of the gamma squeezes peaked and abruptly reversed during the first quarter of 2021. The crypto market faltered shortly after, while tech-growth pounded the final nail in the bubble’s coffin in Q4. Most self-proclaimed market geniuses gave back most (if not all) their hard earned gains as the grinding bear market of 2022 emerged.

Today, we’re more than two years removed from the great growth apex.

But we’re beginning to see signs of life from some in these former bubble stocks and sectors. If you’re looking for strong trade candidates, most of the familiar players from the Covid Bubble are back in the spotlight.

The crypto rally is accelerating this week as Bitcoin makes a run above $40K (it was threatening to break below $25K as recently as mid-September). Short squeezes are triggering across the market’s most beaten-down stocks. And many of the formerly hot tech-growth names are breaking out of big bases following nearly two years of abysmal performance.

Tech Growth Snaps Back

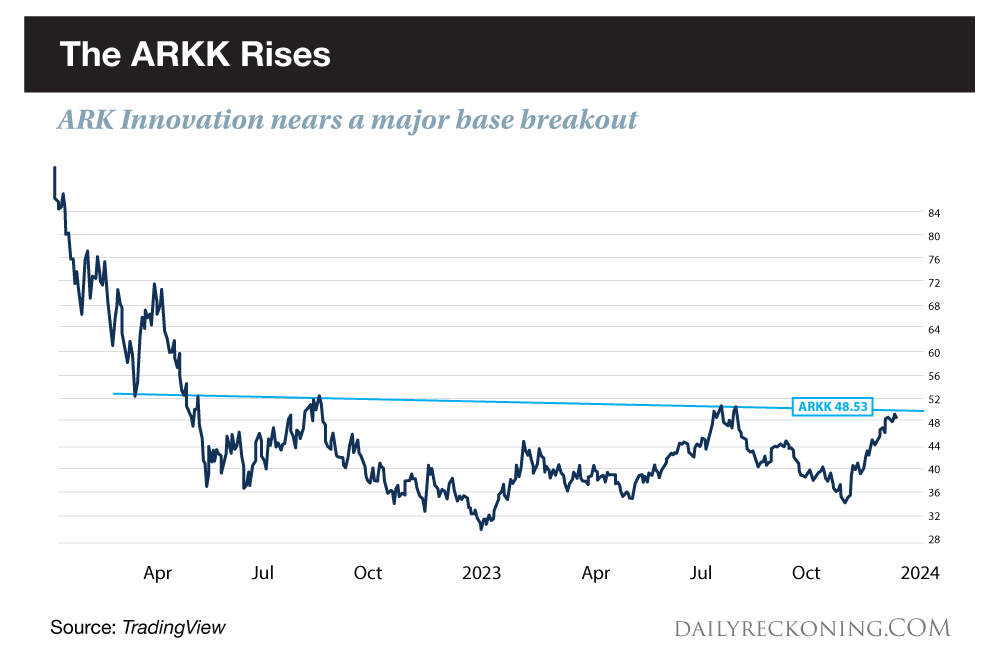

During the summer months, we discussed the resurgence of the ARK Innovation ETF (ARKK) – and how many of its beaten-down components were nearing significant base breakouts.

The decimated tech-growth names looked as if they were finally catching higher as market conditions slowly improved. Many of these stocks began the base building process in late 2022. After several head fakes and retracements, investors were starting to see these stocks sustain breakout moves and actually extend higher.

By July, ARKK had rallied 60% since the beginning of the year. But the stocks fueling the run weren’t all “easy” trades to ride in Q1 and Q2. In fact, the ARKK comeback has been anything but a straight line.

The initial snapback began right as the calendar flipped to January. ARKK rocketed higher by nearly 50% before it flamed out at the start of February, giving back much of its year-to-date gains just as quickly as it rallied. Even more concerning was a brief drop below $35 in May as ARKK tested its March lows. The fund had already slipped below its 200-day moving average and appeared destined for lower prices.

But a big breakdown never materialized. That $35 test held, and ARKK managed to vault off its 200-day moving average following the regional banking crisis scare. It steadily pushed higher – quickly approaching its August 2022 relief rally highs.

Yet once the summer momentum faded, the ARKK stocks encountered some serious turbulence. By late October, ARKK had dropped 30% from its 2023 highs. Some of the individual components were even cut in half as investors worried the market was slipping toward another ugly breakdown.

It was another big test for these former Wall Street darlings. They would either find support and bounce – or tumble into oblivion.

Of course, we all know what happened next. Thanks in part to an abrupt sentiment shift, the market’s heating up as the year winds down. The tech-growth names have done more than just bounce. These stocks are popping left and right – and there’s still time to capitalize on their powerful breakouts.

While ARKK still has some work to do, it’s nearing a major breakout level at $50. If it can post a convincing move about this level, it could sustain a bigger rally into 2024.

If the recent rally is any indication, it’s ready to make the move. ARKK jumped 35% in November, notching its best monthly performance since its inception in 2014, Benzinga reports. I never would have guessed last month was ARKK’s strongest ever – especially looking back on its incredible pandemic ascent.

Even before the Q3 correction, we’ve talked about keeping an eye out for individual tech-growth stocks completing big bases. Now, it’s time to strike as the year winds down. Not every tech-growth stock is going to be a big winner. But the ones that are able to harness this newfound momentum will provide fast returns heading into 2024.

What’s Going On With Gold?

Gold futures quickly shot above $2,100 to kick off December trading. And I’ve told you a quick jump to $2,600 is possible before gold even thinks about consolidating… once we get through some of the whipsaw action.

But gold has somehow fallen back into its range below $2K once again. The VanEck Vectors Gold Miner ETF (GDX) is also struggling.

What gives?

I’ll take you through the charts this morning at 11 a.m. Eastern on Top Trades Live!

I’ll discuss the maddening action we’re seeing in precious metals right now. You’ll also get to see some of my favorite actionable trade setups for the week.

Comments: